2026 Retirement Contribution Limits: How to Avoid IRS Penalties for Over-Contributing

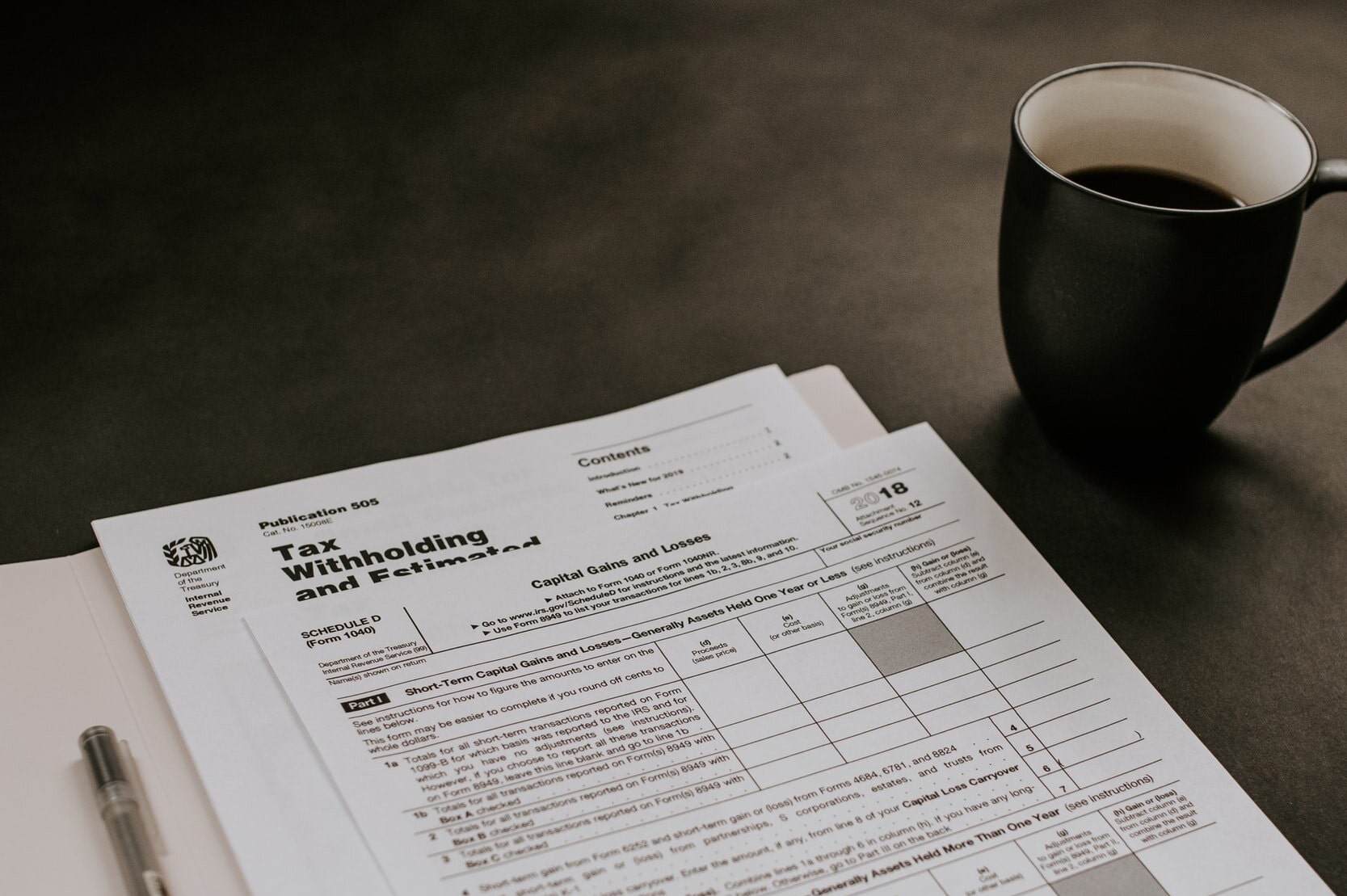

Did you know that the IRS penalizes you for contributing too much into your retirement account? The IRS imposes a 6% penalty for each year

Did you know that the IRS penalizes you for contributing too much into your retirement account? The IRS imposes a 6% penalty for each year

Big Changes Ahead for 401(k) Catch‑Up Contributions Starting in 2026, workers age 50 and older who earn more than $145,000 from their employer will face

Preparing for college isn’t just about academics or choosing the right campus. It’s about making smart financial moves long before applications are due. From navigating

This week has been a rollercoaster for the markets, and I know many of you are feeling anxious. My inbox and phone have been overflowing

Losing a loved one is tough, and sorting through their finances can feel daunting, but they might have left behind unclaimed money that you may

Investing in gold bars can diversify your portfolio, offering a tangible asset that hedges against inflation and economic uncertainty. Unlike stocks or index funds, physical

Achieving financial success is a journey that requires careful planning and disciplined execution. Here are 10 essential steps to help you build a secure and

Want to max out your retirement accounts this year? Below is a checklist to help you determine how much you’re allowed to contribute and the

For many, tax season has become synonymous with stress but preparing now can ease some of that burden.

Why knowing the dates when banks and markets are closed affects the way you manage money.

What’s the best way to start saving for your children?

Which one is better for you?

Does it matter if the person who is filing your taxes is certified?

3 things you can do to get financially ahead

Knowing the holidays the U.S. financial markets and banks are closed is just as important as knowing their daily hours of operation.

What you need to know about filing a tax extension.

With many reasons to file an extension, find out if you should file one.

Take yourself out for a money date to do your taxes.

Maybe you can afford the car, but what about the insurance premium?

Timing may not be everything, but it can make a big difference in what you pay for a car.

Besides clothes and books, here are 4 uncommon items you wouldn’t think to donate.

Get through the holiday season without blowing your budget.