Why we need to redefine what retirement means

Planning for your retirement can be a daunting task, not because of the “math” you have to do to determine how much you need during your retirement years but rather defining what you actually want, need, and expect in your retirement. Determining when you want to retire is just as important as well. Asking yourself […]

Roth 401(k) vs Traditional 401(k): Which should you choose?

In recent years, an increasing number of employers have been offering Roth 401(k) Plans or have been allowing their employees to contribute to both Traditional and Roth 401(k)s. Since this has become more and more common, you may face the question: Which option is best for me? The answer is not as cut and dry […]

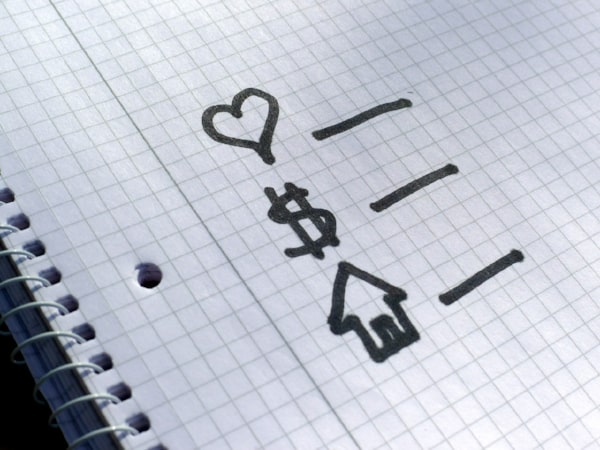

The One Financial Question Millennials Aren’t Asking

If you were born between the years 1981 and 1997, you are considered a Millennial. If you’re part of this generation, you’re probably more concerned about building an emergency fund, paying off student loans, starting a family, buying a home for the first time, traveling the world, or determining how to start saving for retirement. […]