FSA vs. HSA: Which is better for you?

Open enrollment season is nearing. Minimize stress and simplify the process by reviewing your options ahead of time.

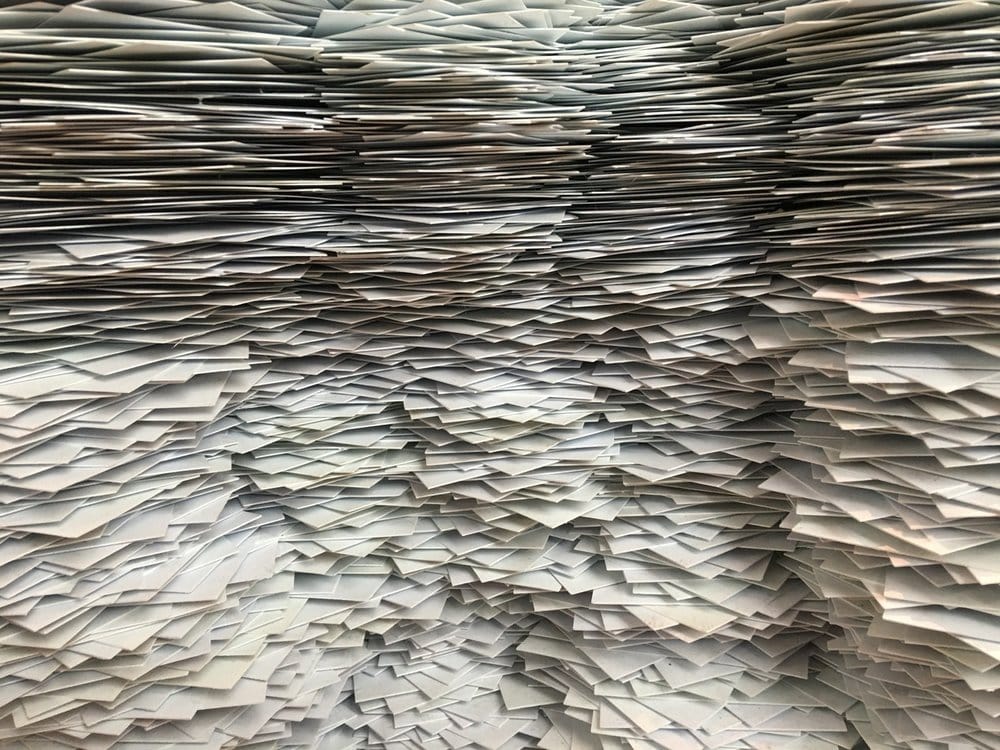

Financial Spring Cleaning: What to Keep vs. Throw Away

It’s spring – a season for new beginnings – and a natural time to ‘clean out the closet.’ Spring cleaning goes far beyond your home life, like deep cleaning or getting rid of old clothes. It’s equally important to spring clean your financial life by examining all your saved documents involving your taxes, savings, investments, […]

Three Ways to Save On Renters Insurance

For those of you paying a mortgage on your home, the phrase “homeowners insurance” is nothing new. When you purchase a new home – whether it be a single family house, a condo or an apartment unit, this type of insurance is typically secured at the time of closing. For renters, however, the requirements are […]

Merging Finances With Your Significant Other? Consider These Factors First

Merging Finances With Your Significant Other? Consider These Factors First

Consolidation vs. Refinancing: What’s The Best Option For Your Student Loans?

Student loans: an all-too-common phrase for most college-educated Americans. While there are common misconceptions out there about the differences between student loan consolidation and refinancing, the fact remains that both options are worthy of exploring if you’re looking to better manage your repayment plan. Most Americans can’t afford to repay student loans in full, but […]

It’s 2018 & It’s Time to Pay Your Future Self First

The holiday season has officially come to a close, and consumers are kick-starting the new year with new goals and resolutions to enjoy a prosperous 2018. ‘Saving more money’ is often found on many resolution lists, with many aiming to improve their financial standing or to put away for a major expense like international travel […]

How to Choose a Credit Card That Rewards You for Your Lifestyle Spending

Do you own a credit card that rewards you for spending your money? If not, it may be time to evaluate the credit cards that you own. Using a credit card to pay for bills or lifestyle expenses monthly is not necessarily a bad thing. Now, that doesn’t mean you should go on a spending […]

What to Ask Yourself When Planning for Your Child’s Financial Future

A lot of parents come to me for advice on how to save for their children’s futures. Most of the time, they ask if a 529 account is the best way to do it. Saving for your kids is not just about the best types of accounts to open. You may need to assess your […]